When optimizing your cash flow and liquidity planning, you'll find countless liquidity management software providers available. But which ones truly stand out from the crowd?

In this article, we highlight and compare ten liquidity management software solutions, detailing their features and key considerations.

Our goal is to provide you with a comprehensive overview, enabling you to make an informed decision and select the ideal software to optimize your liquidity management.

Need a refresher on liquidity planning? Then take a look at our guides to financial planning and liquidity planning.

Overview: 10 liquidity management software finance teams use

- re:cap

- Microsoft Excel

- Tidely

- Commitly

- Atlar

- Finban

- Trovata

- Embat

- Helu

- Nomentia

Comparison: The 10 best liquidity management software in 2025

If you need a quick and comprehensive comparison of liquidity management software providers, including pricing and features, our comparison spreadsheet is here to help.

What should you consider when choosing liquidity management software?

Effective liquidity management software should offer more than just impressive features; it should provide real, tangible benefits that go beyond mere data collection and visualization. To ensure you select the best tool for your needs, ask yourself these questions before purchasing a liquidity management software tool.

For what purpose do I need the liquidity management software?

When selecting liquidity management software, it's crucial to match the solution to your specific needs. Some options are crafted for large, established companies with intricate structures, while others are designed for startups where liquidity and cash management may fall under the founders' purview.

To make an informed choice, assess how you intend to use the software and determine whether its features align with your requirements or if you need a broader or more specialized solution.

How complex are onboarding and maintenance?

If you're dealing with software that takes weeks or even months to onboard and get all rules right until its fully working it's time for a change. You need to get a solution where data sources connect in minutes and operate seamlessly, with quick, accurate, and fully automated integration.

Do I need all the features that the liquidity management software offers?

In general, software with more features comes with a heftier price tag. A free trial is your opportunity to determine whether you truly need all the offered functionalities or if a more streamlined solution would suffice. Avoid investing thousands of euros in a comprehensive software package when you only need a fraction of its capabilities.

How is data quality ensured?

Even the most advanced liquidity management software is only as effective as the data it relies on. To truly excel, a solution must not only classify transactions with precision but also seamlessly handle data cleansing, validation, and enrichment.

Now, let's dive into a liquidity management software comparison.

Looking for a way to manage your liquidity?

Use re:cap to keep track of your cash position. See all bank accounts, balances, and transactions in one place. Use forecasts to plan your liquidity ahead. See all important cash metrics in one place.

Start 14-day free trialCompare and test: 10 Liquidity management software

re:cap

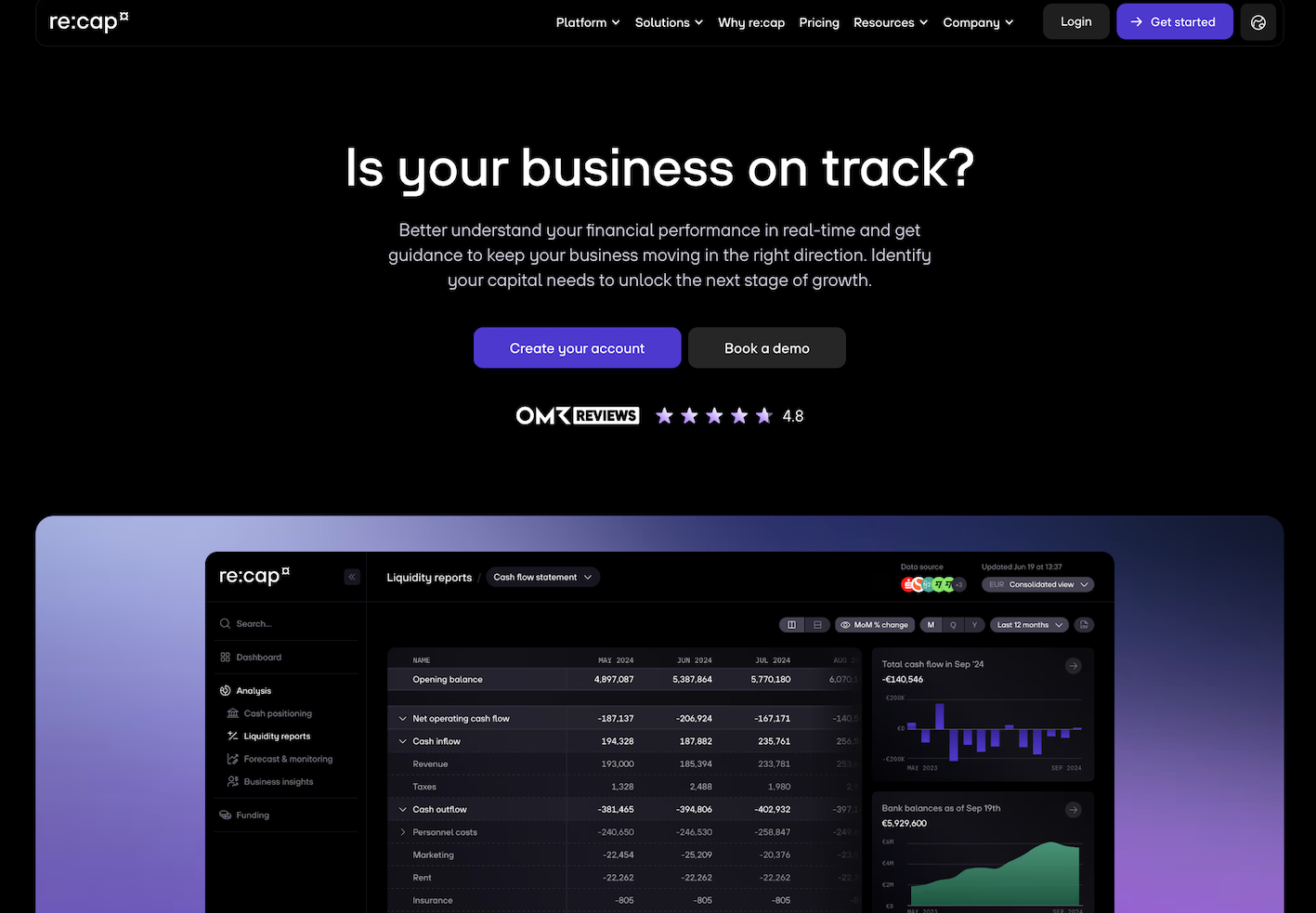

re:cap helps companies make better financial decisions and maximize their capital efficiency. They integrate analysis, forecast, and funding in one platform – the Capital OS. This ensures that financial operations and funding work as one.

The analysis part offers a real-time snapshot of all bank accounts and transactions and automatically categorizes your bank transactions. You'll get immediate access to crucial financial metrics, making it easy to generate reports for management and investors.

Plus, you can do a financial forecast and run simulations, including stress tests, to ensure you're ready for any scenario.

re:cap pricing

With re:cap, you can choose between two different plans: Essential and Pro.

Essential

- For free

- Real-time basics: cash flow, burn rate, runway

- Access funding info and covenants

- One pre-defined long-term liquidity forecast

Pro

- Starts at €79 per month

- Full control: customizable dashboards & forecasts (weekly + monthly), unlimited scenarios

- Detailed cash flow & transaction analyses

- Covenant alerts

- Expert support

Funding (for both plans when funded):

- Flexible, non-dilutive credit line (€50K-€5M)

- Terms between 1-60 months

- No warrants, equity kickers, or personal guarantees

You can find all the information on our pricing page.

You can invite unlimited users and link as many bank accounts as you need, regardless of your plan.

Key capabilities

Analysis

With Analysis, companies bring all their financial data in real-time into one place. They see cash balances, runway, and growth at a glance, track transactions across accounts, and understand where money flows. Benchmarks, capital needs, and a rating system show how fundable a company is and what to improve.

The cash management of re:cap covers a wide range of functions:

- With the cash flow statement, we automatically categorize all your transactions, making it easy for you to track all cash inflows and outflows.

- With the P&L statement, you can leverage real-time profitability analysis to stay updated and make optimizations.

- The runway analysis helps you to keep a close eye on your cash burn and runway to enhance your financial strategy and ensure better planning.

- Consolidation helps you to gain insights into liquidity across various levels, company structures, and entities.

- With Plan vs. Actuals, you can compare your business plan projections with actual results to spot deviations.

- You gain access to over 14,000 bank accounts, allowing you to view all your financial information on one platform.

- Get a complete picture: build your company reports on a comprehensive understanding of liquidity, customers, profitability, and financial health by connecting banking, revenue, and accounting data.

- Single source of truth: you’re always prepared to discuss financial metrics and answer any finance-related questions from your management team with confidence.

- Report better with less work: extract key business metrics that matter most to your investors and save time on repetitive manual investor reporting.

- Ensure financial precision: track revenue, costs, cash flow, and balances to ensure projected outcomes match reality. This sharpens your financial precision and enhances plan accuracy.

Forecast

With Forecast, companies plan short-term liquidity and long-term capital needs in one place. Using cash flow, invoices, actuals, and budgets, they create weekly and monthly forecasts, test scenarios, and add funding events to see the impact. This shows them clearly when capital is needed, what is possible with the funds available, or what kind makes sense.

It covers the following areas:

- Craft a forecast (short-term or long-term) based on historical data, with the flexibility to manually adjust and explore different scenarios.

- Get a clearer picture of how major decisions (funding, new hires, large expenditures, or mergers and acquisitions) could affect your cash flow.

- Conduct stress tests to see how key metrics perform under pressure, helping you pinpoint critical areas to address in your financial strategy.

- Assess how debt and equity investments influence your financial planning and liquidity.

What do companies use re:cap for?

Our customers use re:cap for different purposes:

- Get an instant, transparent view of account transactions and cash balances, automatically updated from your bank accounts.

- See all key financial metrics at a glance, whether for the entire organization or individual entities.

- Keep your management team and investors informed with critical metrics like burn rate, revenue growth, and cash balance.

- Spot opportunities to save money and cut costs.

- Monitor your budget closely and respond quickly to any deviations.

- Simplify budget planning with clear comparisons between business plan targets and actual performance.

- Plan your liquidity more precisely by creating customized scenarios to model and understand future developments.

- Conduct liquidity stress tests to see how various impacts affect other areas of your business.

Summary re:cap

With re:cap, you gain access to the Capital OS and can analyze and manage your, create forecasts to see what and how much funding you need, and directly access it.

Microsoft Excel

For more than 30 years, startups, SMEs, and large corporations have trusted Microsoft Excel. The tool not only handles calculations and data analysis but also creates charts. Excel is a solid solution for managing liquidity.

Microsoft Excel pricing

With Excel, you have two options: Excel as a standalone product and Excel within the Microsoft 365 product world.

- Excel standalone: $159

- Excel within Microsoft 365: $6.99 per month

What do companies use Microsoft Excel for?

Excel is a staple in business for managing liquidity, financial planning, payment tracking, and budget monitoring. Yet, when it comes to effective liquidity management, Excel falls short.

Excel’s manual input poses major challenges to effective liquidity management. Lacking essential features like automatic data integration, it turns account balance maintenance into a time-consuming, error-prone task.

Without real-time updates, liquidity planning and forecasting become guesswork, with the added risk of losing critical data from previous scenarios. These shortcomings make Excel ill-suited as a reliable liquidity management tool.

Summary Microsoft Excel

Excel works for simple liquidity management with one account and a few transactions. But as complexity grows, Excel has its limitations. Modern liquidity management software offers advanced features and efficiency, making it the right choice for managing your cash flow.

Tidely

Tidely is a liquidity management solution tailored for SMEs and large enterprises. It delivers real-time financial visibility and control, featuring a dashboard, cash flow forecasts, scenario planning tools, and reporting.

Tidely pricing

Tidely’s pricing is tailored to your company’s size, user count, and number of bank accounts. They offer four distinct plans: Starter, Professional, Business, and Enterprise.

The Starter and Professional plans, however, come with specific limitations, allowing for only 1 and 5 bank accounts and 1 and 2 users, respectively. To help you make an informed decision, Tidely provides a 7-day free trial, allowing you to explore their features before you commit.

- Starter: €45 per month (billed annually)

- 1 bank account connection

- 1 user

- Professional: €85 per month (billed annually)

- 5 bank account connections

- 2 users

- Business: €215 per month (annual billing)

- 10 bank account connections

- 5 users

- Enterprise: Customized prices

What do companies use Tidely for?

Tidely's liquidity management software offers a suite of features. Here’s what you can expect:

- Liquidity overview: get a view of your financial landscape with all your data integrated.

- Liquidity planning: forecast your cash flow and explore scenarios to anticipate how your liquidity develops.

- Reporting: create and distribute reports to your team and stakeholders.

- Team and company management: oversee cash flow across teams, structures, and business units.

- Transaction and invoice management: connect your bank accounts and ERP systems for transaction and invoice processing.

Summary Tidely

With Tidely, you gain access to liquidity management software designed to streamline and enhance your cash management tasks.

Commitly

Commitly is a liquidity management tool, which provides a transparent view of your cash flow and enhances your business’s financial health. It focuses on financial forecasting with which you can plan your liquidity. It is designed for SMEs and startups.

Commitly pricing

Commitly’s pricing takes into account factors like company size, user count, and the number of bank accounts. You can choose from three plans: Basic, Business, and Professional. Plus, you can access a 14-day free trial to test the liquidity management software.

- Basic: €45.83 per month (annual billing)

- Bank account connections: 1

- Number of users: 1

- Professional: €70.83 per month (annual billing)

- Bank account connections: 3

- Number of users: 5

- Business: €120.83 per month (annual billing)

- Online accounts: 8

- Number of users: 8

What do companies use Commitly for?

Commitly offers a range of features to help you manage your cash flow and plan your liquidity effectively, including:

- Bank and ERP Integration: seamlessly connect your bank accounts and ERP systems with Commitly.

- Liquidity overview: gain a daily snapshot of your cash flow, tracking both inflows and outflows.

- Liquidity planning: simulate different scenarios to forecast how your cash flow will evolve.

Summary Commitly

Commitly is a liquidity management tool that provides a view of your cash flow and critical metrics. With its robust forecasting capabilities, you can plan with precision and model diverse scenarios.

Atlar

Atlar is a liquidity management solution tailored for cash management, payment processing, and cash flow forecasting. Engineered for medium to large enterprises, Atlar helps businesses to optimize their financial operations.

Atlar pricing

Atlar’s pricing is tailored to a company's size and the features it chooses. The pricing itself is not publicly available as you get a personalized quote. Atlar offers three plans: Essential, Professional, and Enterprise. There is no information about a free trial and, according to Atlar, implementation takes 2-3 months.

What companies use Atlar for

Atlar's liquidity management software offers a range of applications, including:

- Cash management: monitor your cash positions in real time and view your financial status.

- Payments: optimize your payment processes for better efficiency.

- Cash flow forecasting: Model liquidity and explore scenarios to project future cash flow.

Summary Atlar

Atlar is a liquidity management software that allows you to cover the basic areas of cash management.

Finban

Finban is a financial planning software tailored for agencies, SMEs, startups, and SaaS companies. Powered by finbot, a smart personal assistant, the platform delivers intelligent insights.

finbot automatically analyzes your data, generates customized reports, provides actionable recommendations, and notifies users of irregularities or potential concerns.

Finban pricing

Finban offers three pricing plans, each with a 14-day free trial and the flexibility to upgrade at any time. All prices are exclusive of VAT. The number of bank connections and users varies depending on the plan.

- Starter Plan

- Monthly payment: €35 per month

- Annual payment: €26.25 per month

- 1 bank connection

- 1 user

- Business Plan

- Monthly payment: €65 per month

- Annual payment: €48.75 per month

- 3 bank connections

- 5 users

- Professional Plan

- Monthly payment: €120 per month

- Annual payment: €90 per month

- 10 bank connections

- 10 users

Key features

Finban offers streamlined cash flow and financial forecasting for companies and founders. It helps answer key questions like: What happens if we don’t acquire new customers? Can we hire new employees? How will tax payments impact our business? Key features include:

- Liquidity Planning

- Scenarios & Forecasting

- Budget Planning

- Analytics & Reporting

- Personnel Planning

Summary Finban

Finban is a financial planning software designed to assist agencies, SMEs, startups, and SaaS companies. It leverages finbot, a smart personal assistant, to automatically analyze data, generate customized reports, provide actionable insights, and notify users of potential concerns.

The platform offers flexible pricing plans with a 14-day free trial and the option to upgrade. Its features include cash flow management, scenario planning, budget planning, analytics, and personnel forecasting.

Trovata

Trovata is a cash management platform that helps large companies and corporations automate their cash flow processes. It centralizes multi-bank data and provides a dashboard for liquidity management.

With features like automated cash flow analysis, forecasting, and real-time insights, it simplifies financial oversight.

Trovata pricing

Trovata’s pricing is tailored to a company’s size and needs. The base package costs €24,000 per year and includes:

- Up to 10 users

- Up to 100 data connections

- Up to 1 million transactions

What companies use Trovata for

Trovata helps businesses optimize cash flow and improve financial transparency. It consolidates data from multiple bank accounts, automates reporting, and delivers accurate cash flow forecasts. This enables better financial decisions and early detection of potential liquidity gaps.

Key features

- Cash Flow Analysis: automated tracking of cash movements to identify trends and patterns.

- Cash Forecasting: accurate projections based on historical data and real-time trends.

- Cash Positioning: a single view of all financial data and metrics.

- Cash Reporting: generates reports without manual effort.

- Multi-Bank Integration: combines data from multiple accounts for a comprehensive financial overview.

Summary Trovata

Trovata is built for enterprises managing cash across multiple entities and jurisdictions. It streamlines cash management with automation, real-time insights, and centralized control. It helps companies stay ahead of financial risks.

Helu

Helu is a cash flow software designed for startups and small to mid-sized businesses. It integrates seamlessly with DATEV and specializes in real-time financial reporting.

Helu pricing

Essentials Plan:

- 1 user

- 3 reports

- 3 pivot tables

- 3 exports per month

Premium Plan:

- 3 users

- 10 reports

- 10 pivot tables

- 10 exports per month

Professional Plan:

- 10 users

- 30 reports

- 30 pivot tables

- 30 exports per month

Enterprise Plan:

- Custom solutions

What companies use Helu for

Helu helps companies analyze financial data, plan budgets, and improve team collaboration. It provides reporting tools, forecasting capabilities, and an integrated approach to financial management.

Key features

- Analysis: Visualization and interpretation of financial data.

- Planning: Budgeting and forecasting to support financial decision-making.

- Collaboration: Shared report creation and editing for better teamwork.

- Consolidation: Integration of financial data from various sources for a comprehensive overview.

- DATEV Integration: Automated data exchange with DATEV.

Summary Helu

Helu streamlines financial reporting by automating data consolidation and report generation. It simplifies collaboration across teams and reduces the time spent on financial reporting.

Embat

Embat is a cash flow software designed for mid-sized and large companies looking to automate and streamline their financial processes. The platform connects to bank accounts in real time, allowing users to manage cash flow, debt, and forecasts.

Embat pricing

Embat offers three pricing plans: Starter, Professional, and Enterprise. Pricing details are not publicly available. Contact the sales team for a quote.

What companies use Embat for

Companies use Embat to digitize treasury processes, gain real-time financial insights, and reduce manual tasks. The software visualizes cash flow, automates reporting, and generates liquidity forecasts.

Key features

- Real-Time Bank Connectivity: access financial data from over 13,000 institutions worldwide.

- Cash Flow Forecasting: short-, mid-, and long-term liquidity planning.

- Automated Accounting: AI-driven processes for bookkeeping and reconciliations.

- Centralized Payment Management: handle all payments from a single platform.

- Custom Reports & KPIs: tailored analytics for better decision-making.

Summary Embat

Embat is a comprehensive cash management tool that supports businesses in all key financial operations.

Nomentia

Nomentia is a software solution for managing payments, liquidity, and treasury operations. It is designed primarily for large enterprises. With Nomentia, you can centrally monitor and manage liquidity, improving financial transparency and decision-making.

Nomentia pricing

There is no publicly available pricing information for Nomentia.

What do companies use Nomentia for?

The platform provides tools for managing bank accounts, analyzing bank fees, and forecasting cash flow.

Key features

- Payment Hub: centralizes and controls all corporate payment flows.

- Liquidity Management: monitors and manages group-wide liquidity in one place.

- Cash Flow Forecasting: generates accurate predictions by consolidating data and using AI.

- Bank Account Management: centrally manages and monitors all corporate bank accounts.

- Treasury Reporting: compiles treasury reports using data from various systems and banks.

Summary Nomentia

Nomentia is a comprehensive liquidity and treasury management solution that helps businesses streamline payment and liquidity processes.

Summary: The 10 best liquidity management software

After a thorough evaluation of the top ten liquidity management software solutions, we’ve assessed each option across a range of key criteria. Each software offers unique advantages and limitations. To assist you in making a well-informed decision, we’ve crafted a clear and concise comparison table.

Our selection encompasses a diverse range of choices, from sophisticated, high-end solutions to intuitive, user-friendly tools. Some software options come with a wealth of features, which may involve a more extensive onboarding process and a steeper learning curve.

On the other hand, there are solutions designed for swift setup and ease of use, offering essential cash flow management capabilities through a streamlined, intuitive interface.

Q&A: Liquidity management software

What is liquidity management?

Liquidity management involves monitoring and optimizing a company's cash flow to ensure it has enough cash on hand to meet short-term obligations, like paying bills, salaries, and other operational costs.

It helps businesses balance their cash inflows and outflows effectively to avoid liquidity shortages or excesses.

What is liquidity management software?

Liquidity management software helps businesses track, analyze, and manage their cash flow in real-time. It automates the process of monitoring cash positions, projecting future liquidity, and ensuring funds are available for operational needs or strategic investments.

This software also helps in forecasting, reporting, and scenario planning to support better decision-making.

How do I use liquidity management software?

To use liquidity management software, you typically start by integrating it with your bank accounts and financial data sources. The software automatically collects and analyzes real-time data, generating cash flow forecasts and reports. From there, you can make informed decisions about cash allocation, plan for future cash needs, and adjust based on changing financial conditions or business goals.

What is the best liquidity management software?

The best liquidity management software depends on your business’s size, needs, and complexity. The ideal software aligns with your business objectives, offers user-friendly interfaces, and integrates well with your existing financial systems.

Looking for a way to manage your liquidity?

Use re:cap to keep track of your cash position. See all bank accounts, balances, and transactions in one place. Use forecasts to plan your liquidity ahead. See all important cash metrics in one place.

Start 14-day free trial.svg.png)

.gif)